Malaysia Personal Income Tax Guide 2017. It also incorporates the 2018 Malaysian Budget proposals announced on 27 October 2017.

Malaysian Bonus Tax Calculations Mypf My

Chargeable income for the first RM 500000 19 18 From YA 2017.

. Taxable Income RM 2016 Tax Rate 0 - 5000. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. Malaysia Corporate Tax Rate 2017 Table.

Modal berbayar sehingga RM25 juta pada awal tempoh asas. 20001 - 35000. Historical Chart by prime ministers Najib Razak.

Irs Announces 2018 Tax Brackets Standard Deduction Amountore Paying Ta 2020 Overall Ranking And Data Tables Pwc Table A. A gains or profits from a business. The study adopts the theory of taxation by Ibn Khaldun depicted as the Laffer curveThe paper analyses time series data for the period 1996 to 2014 using the autoregressive distributed lag ARDL approachThe paper finds that the corporate.

Corporate Tax Rate in the United Kingdom averaged 3068 percent from 1981 until 2021 reaching an all time high of 52 percent in 1982 and a record low of 19 percent in 2017. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. Technical or management service fees are only liable to tax if the services are rendered in Malaysia.

Malaysias corporate tax rate has in line with others in ASEAN gradually reduced from 28 YA2006 to 24 YA2017 and the effective rate is even lower. 13th April 2017 - 7 min read. However gains derived from the disposal of real property.

Interest on loans given to or guaranteed by the Malaysian government is exempt from tax. Classes of income Income tax is chargeable on the following classes of income. Chargeable income MYR CIT rate for year of assessment 20212022.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. 35001 - 50000. Malaysia Corporate Tax Rate 2017 Table.

Responsibilities Rights of Individual. Malaysia personal income tax rates what is the income tax rate in malaysia individual income tax in malaysia for budget 2017 new personal tax rates for. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia.

Malaysia Personal Income Tax Rates 2017 Updates Budget Business News Budget 2017 New Personal Tax Rates For Individuals Ya2017 Updates Business News. Corporate - Taxes on corporate income. Capital Gains Tax in Malaysia.

Corporate Tax Rates in Malaysia. The current CIT rates are provided in the following table. Malaysia Corporate Tax Rate chart historic and current data.

Tax under the Labuan Business Activity Tax Act 1990 instead of the Income Tax Act 1967 ITA. Tax rates on. 5001 - 20000.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. What is the Corporate Tax Rate in Malaysia. In general capital gains are not taxable.

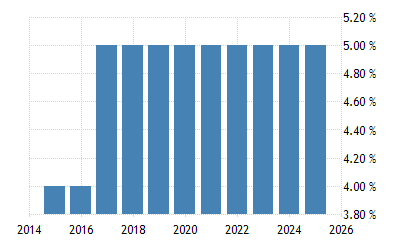

Corporate companies are taxed at the rate of 24. Malaysia Corporate Tax Rate was 24 in 2022. Last reviewed - 14 December 2021.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. Malaysia personal income tax rates malaysia personal income tax rates 2017 budget 2017 new personal tax rates for personal tax archives updates. For individuals with business source the due date is.

Current Malaysia Corporate Tax Rate is 3920. Income tax rates. In addition the Government has also proposed a reduction of corporate tax rate based on the annual increase in chargeable income for YAs 2017 and 2018 as follows.

Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. S. RM500000 for YA 2017.

30 October 2017 Rankings show at least half of the Association of Southeast Asian Nations sit in the second half or less complex end of the financial complexity spectrum. Masuzi June 29 2018 Uncategorized Leave a comment 22 Views. While the 28 tax rate for non-residents is a 3 increase from the previous years 25.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. The present study aims to investigate the impact of the reduction of the corporate tax rate on corporate tax revenue. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015.

Malaysia Corporate Tax Rate 2017 Table. The current CIT rates are provided in the following table. 10 Year Treasury Rate.

Malaysia Corporate Tax Rate for Dec 2017 Mean. Last reviewed - 13 June 2022. 20172018 Malaysian Tax Booklet.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. See also Are Dugout Box Seats At Busch Stadium All Inclusive. The current CIT rates are provided in.

A Labuan entity can make an irrevocable election to be taxed under the ITA in respect of its Labuan business activity. Chargeable income RM Existing tax rate Proposed tax rate Effective date SME.

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Mutual Agreement Procedure Statistics For 2017 Oecd

Individual Income Tax In Malaysia For Expatriates

Why It Matters In Paying Taxes Doing Business World Bank Group

Asiapedia Iras 2017 Singapore Personal Income Tax Dezan Shira Associates

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Doing Business In The United States Federal Tax Issues Pwc

Effective Tax Rate Formula Calculator Excel Template

Corporate Profit Shifting And The Role Of Tax Havens Evidence From German Country By Country Reporting Data Eutax

Corporation Tax Europe 2021 Statista

Eritrea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Checkout The Gst Rate Chart 2017 Now Here At Taxguru Find Out The The Changes Made By Gst In India Chart Rate Goods And Service Tax

Rates For Regular Gym Memberships At Miracles Fitness At The Garage Ocean View Gym Membership Fitness Membership Garage Gym

Why It Matters In Paying Taxes Doing Business World Bank Group

Company Tax Rates 2022 Atotaxrates Info

Economy Of Malaysia Economic Outlook History Current Affairs Malaysia Economy Outlook